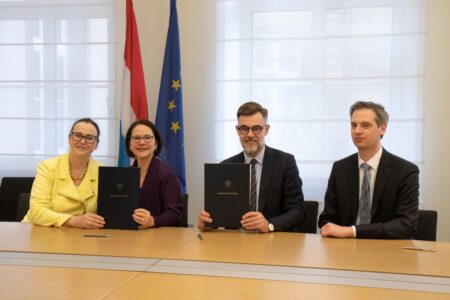

The equity investment new fund, which succeeds the existing Luxembourg Future Fund that has reached the end of its active investment period, was presented by the Ministry of Finance, the Ministry of the Economy, Société nationale de crédit et d’investissement (SNCI) and the European Investment Fund (EIF). The launch of LFF 2 highlights the successful cooperation between SNCI and EIF aiming to stimulate the diversification and sustainable development of the Luxembourg economy via funding activities.

This complementarity helps focus investments in innovative technologies that will generate a sustainable and positive impact in key sectors like finance and climate technologies.

“With the launch of the LFF 2, we will pursue a unique partnership that is built on the EIF’s deep expertise of managing public policy focused investment initiatives and the SNCI’s as well as the knowledge of the Luxembourg economy of both the Ministry of Finance and the Ministry of the Economy,” said Minister of Finance Yuriko Backes. “This complementarity helps focus investments in innovative technologies that will generate a sustainable and positive impact in key sectors like finance and climate technologies, thus contributing to the further diversification of our economy.”

“With the launch of the LFF 2, we will pursue a unique partnership that is built on the EIF’s deep expertise of managing public policy focused investment initiatives and the SNCI’s as well as the knowledge of the Luxembourg economy of both the Ministry of Finance and the Ministry of the Economy,” said Minister of Finance Yuriko Backes. “This complementarity helps focus investments in innovative technologies that will generate a sustainable and positive impact in key sectors like finance and climate technologies, thus contributing to the further diversification of our economy.”

Equity investment in climate, fintech, cyber, energy, life sciences and space

Like LFF 1, LFF 2 will target a risk-adjusted financial returns whilst simultaneously stimulating the diversification and sustainable development of the Luxembourgish economy with investments across a range of sectors including climate technologies, fintech, cybersecurity, energy resilience, life science and medical technologies, as well as new space technologies.

LFF 2 will provide an important tool in driving forward the diversification of the Luxembourg economy and the development of its strategic sectors by cooperating with the private sector in pursuit of sustainable innovation.

“From a public policy perspective, LFF 2 will provide an important tool in driving forward the diversification of the Luxembourg economy and the development of its strategic sectors by cooperating with the private sector in pursuit of sustainable innovation here in Luxembourg,” Minister of the Economy Franz Fayot pointed out.

Wider scope for investment

LFF 1 has established itself as a catalyst for international start-ups and investment funds willing to establish their presence in Luxembourg. Its portfolio includes, for example, space data analytics company Spire Global, space monitoring company NorthStar and financial services firm Cyberhedge. In line with the existing LFF 1 initiative, investments under LFF 2 will continue to take place in the form of fund commitments and/or co-investments. However, compared to LFF 1 the investment scope has been broadened and will now:

- Include investment funds and businesses already established in Luxembourg, thereby allowing these entities to expand local operations further.

- Target more mature innovative businesses by providing hybrid debt-equity investments. These less dilutive investment instruments may appeal to companies unwilling to give up further equity stakes. Thus, the addition of hybrid debt-equity investments will allow LFF 2 to invest into companies at different stages of development.

- As such, investments will also be considered for more mature companies, facing a complex and uncertain market environment, including businesses currently exposed to changes in digitalisation, supply chain disruptions or companies transitioning to a low-carbon business model.

Photo credit: Ministry of the Economy